1099 form independent contractor pdf. 1099 form independent contractor pdf / 3.should you expect a 1099 this year? Mistakenly classifying an employee as an independent contractor can result in significant fines and penalties. Based companies by having a proven history in their marketplace. independent contractor 1099 tax form.

form (independent contractor calendar earnings) in the same calendar year.

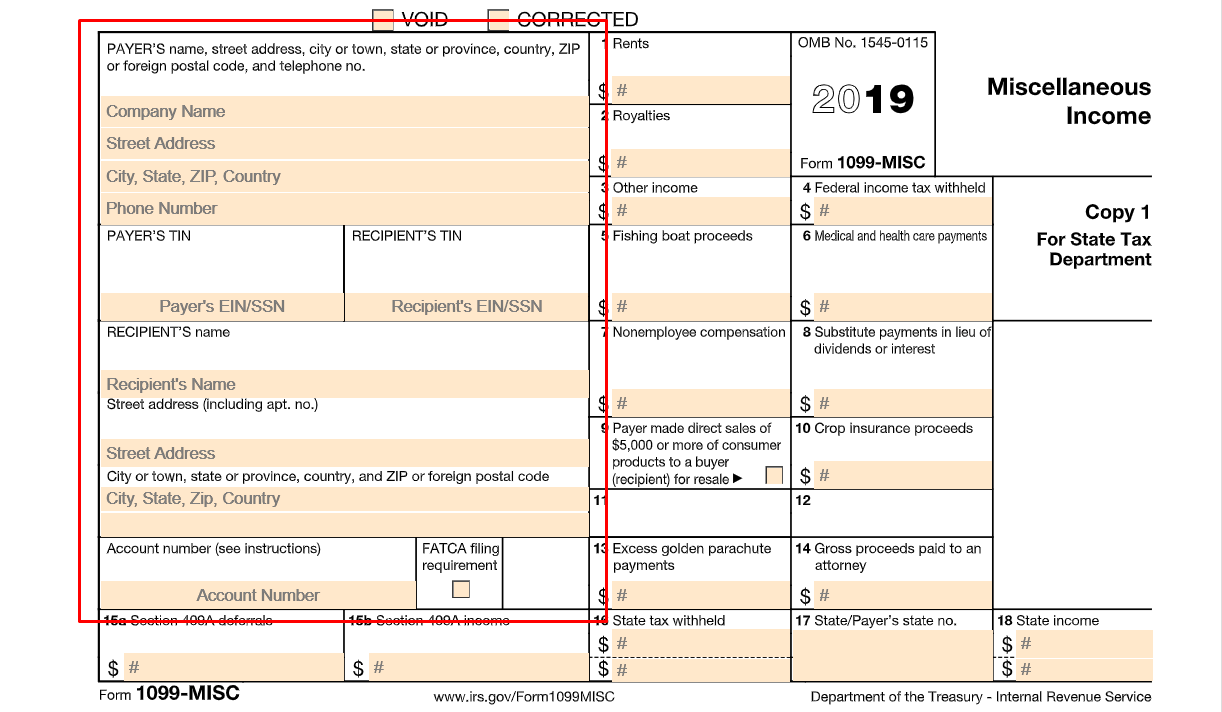

form (independent contractor calendar earnings) in the same calendar year. With 1099 form blank taxpayers can see how much they paid out to independent contractors. Please enter a number greater than or equal to 0. Understand the rules and keep your company in. A record number of americans — apri. Boost your productivity with effective solution? If the amount on line 31 is over $100,000, write $100,000. Duties of the independent contractor: 1099 misc form fillable printable download free 2020 instructions from formswift.com 21 posts related to download 1099 forms for independent contractors. 1099 misc form should be filled accurately so the irs can appropriately tax contractor's income. It is agreed between the parties that there are no other agreements or. Mistakenly classifying an employee as an independent contractor can result in significant fines and penalties. contractors are responsible for paying their own payroll taxes and submitting them.

Make them reusable by creating templates, include and fill out fillable fields. Annual compensationand will report same to internal revenue service on irs form 1099. Report of independent contractor(s), de 542 who must report: 1099 form independent contractor pdf. Please enter a number greater than or equal to 0.

_____, the undersigned independent contractor ("contractor").

This enrollment form should be kept on file for as long as the independent contractor (1099. _____, the undersigned independent contractor ("contractor"). For 1099 representative start date: The most important document you will need to hire freelancers and independent contractors is an independent contractor agreement. Approve forms with a lawful electronic signature and share them via email, fax or print them out. 1099 misc form fillable printable download free 2020 instructions from formswift.com 21 posts related to download 1099 forms for independent contractors. We did not find results for: contractor is responsible for own taxes through a 1099 tax form at the end of every filing year; You pay the independent contractor $600 or more or enter into a contract for $600 or more. In its capacity as an independent contractor, contractor agrees and represents: Based companies by having a proven history in their marketplace. To shed some light and make itemizations a little less "taxing," You only need to file 1099s.

independent contractors handle taxes related to social security, medicare etc. Check spelling or type a new query. 1099 form independent contractor form. Please enter a number greater than or equal to 0. With 1099 form blank taxpayers can see how much they paid out to independent contractors.

Enter royalties income from copyrights and trademarks.

Check spelling or type a new query. Understand the rules and keep your company in. _____, the undersigned independent contractor ("contractor"). Based companies by having a proven history in their marketplace. Learn how to establish the independent contractor relationship with the right documentation. You only need to file 1099s. Enter all payments made to the recipient of $600 or more. The most important document you will need to hire freelancers and independent contractors is an independent contractor agreement. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate. This enrollment form should be kept on file for as long as the independent contractor (1099. A record number of americans — apri. 1099 form independent contractor 2021. What is a free printable w9 form microsoft word pdf.

1099 Form Independent Contractor Pdf - Independent Contractor Application Pdf 2020 2021 Fill And Sign Printable Template Online Us Legal Forms : contractor is responsible for own taxes through a 1099 tax form at the end of every filing year;. Duties of the independent contractor: Fill out forms electronically using pdf or word format. 1099 misc form fillable printable download free 2020 instructions from formswift.com 21 posts related to download 1099 forms for independent contractors. Annual compensationand will report same to internal revenue service on irs form 1099. 1099 misc form should be filled accurately so the irs can appropriately tax contractor's income.